OwnUp Mortgage Shopping

Advocating for home loan borrowers in high interest times

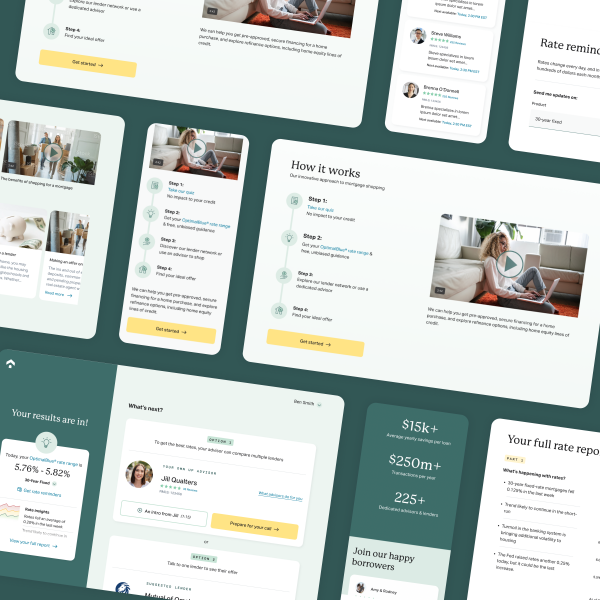

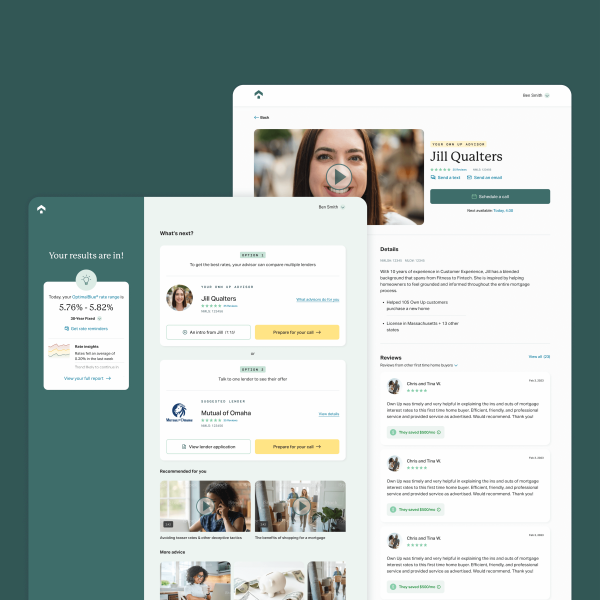

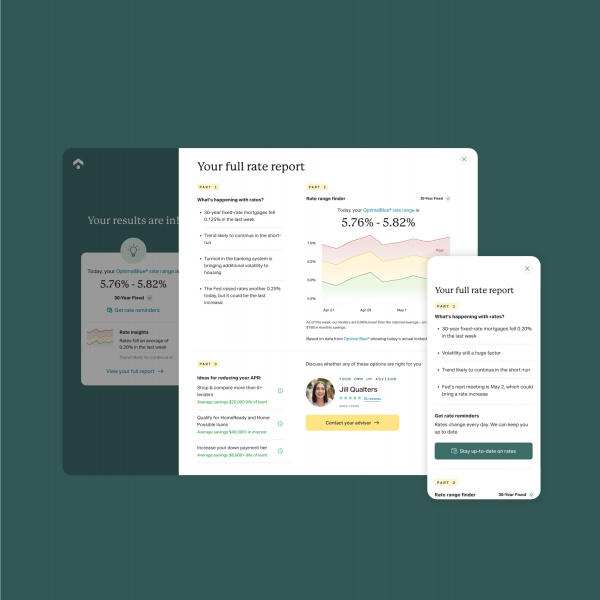

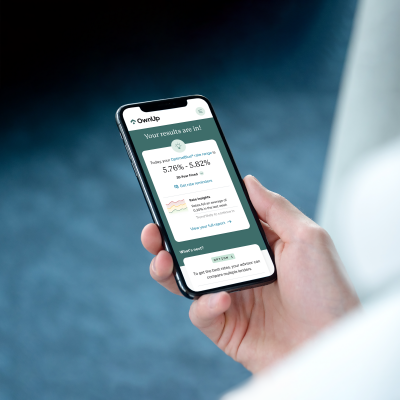

We demystified the home financing experience to help connect borrowers with their best loan option.

-

Alignment Workshops

Bring stakeholders together through structured, facilitated sessions that establish priorities and strategies for a path forward.

-

Experience Strategy

We evaluate internal perceptions, user goals and best practices to find that “special sauce” that drives an actionable roadmap for your future experience.

-

Design Studios

Leverage the collective wisdom of your team to create breakthrough ideas through facilitated, collaborative workshops, resulting in a shared vision.

-

Visual Design

Through imagery, messaging, color and typography, we deliberate over pixels, consistency, readability, contrast, accessibility and creativity.

-

Prototypes

If a picture is a thousand words, a high-fidelity prototype is the entire story. Bringing the user experience to life with a fully-interactive artifact is a low-cost, high-value way to iterate without the investment of code.